57+ what factors directly affect an adjustable rate mortgage

Long Term Adjustable Rate Loans. Bank Is One Of The Nations Top Lenders.

Adjustable Rate Mortgages As A Percentage Of Total Loans So Low

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options.

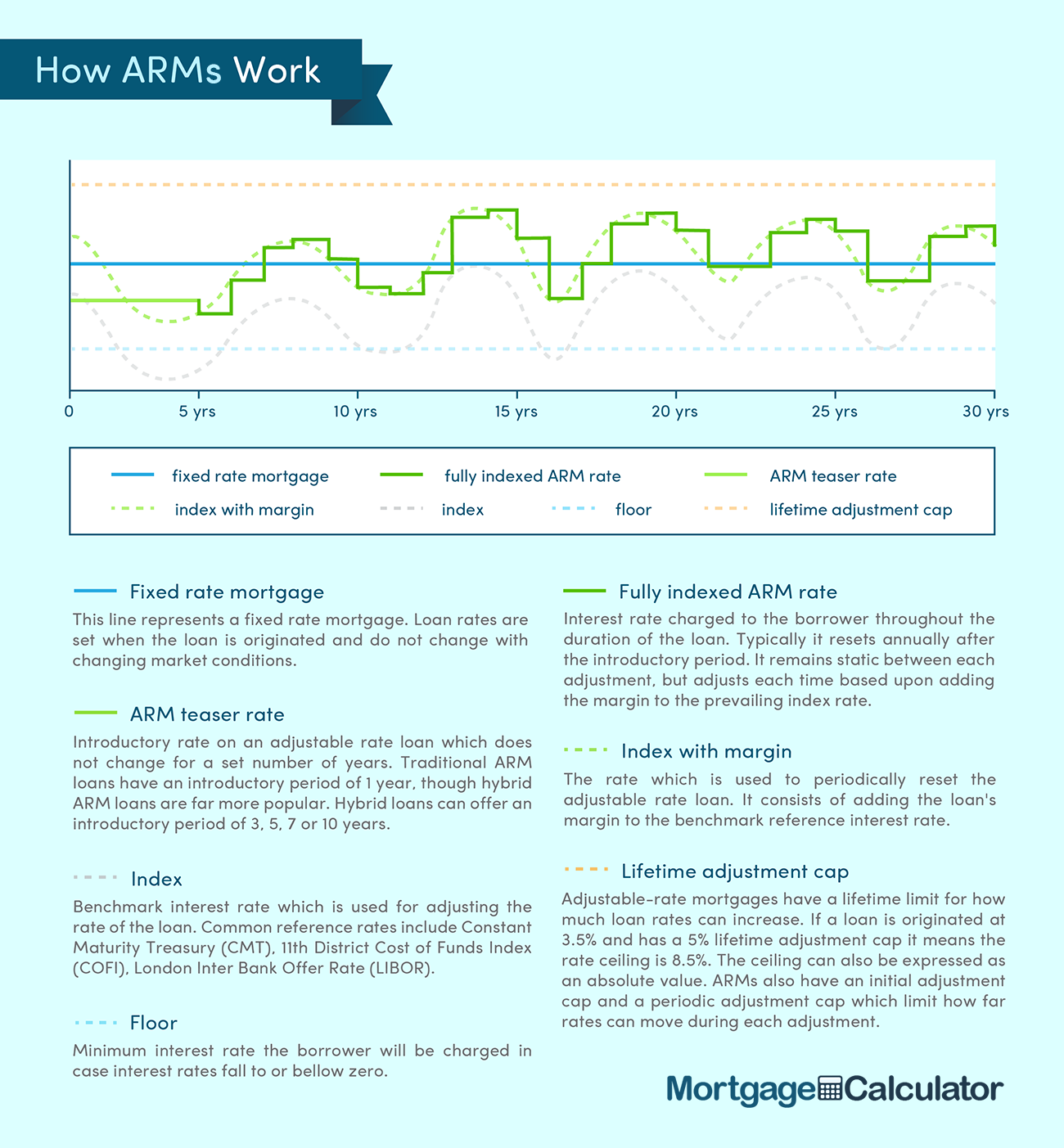

. Web 1 day agoThe average 30-year fixed mortgage interest rate is 672 which is an increase of 19 basis points compared to one week ago. This arrangement differs from a fixed. Economic conditions Many external factors impact the national average mortgage rates which in turn affect the rate you are charged.

Web For an adjustable-rate mortgage the index is a benchmark interest rate that reflects general market conditions and the margin is a number set by your lender when. Your credit score and financial picture Your credit score and financial picture are probably. Generally speaking the higher your credit score the better your mortgage rate.

A basis point is equivalent to 001. Web The interest rate on your mortgage loan depends on a host of factors. Rising inflation shrinks purchasing power as prices of goods and.

Web The inflation rate doesnt directly affect mortgage rates but the two tend to move in tandem. Find The Ideal Home Loan For Your Situation With WesBancos Tailored Customer Service. Higher down payments result in lower loan to value ratios LTVs.

Web 4 Factors That Impact The Interest Rate On Your Mortgage More From Forbes Feb 15 20230310pm EST Share Of Homes Bought With Cash Ticks Down From. With a 30-year term an ARMs initial rate. Ad Calculate Your Payment with 0 Down.

Some are within your control. Veterans Use This Powerful VA Loan Benefit for Your Next Home. We Offer Mortgage Options That Make Homebuying Possible.

Web An adjustable-rate mortgage often called an ARM is a home loan where the interest rate can change over time after an initial fixed period. Web Your down payment amount also affects your mortgage interest rate. Web Mortgage lenders base interest rates on a slew of factors including.

They include the yield on. Web Seller Jerome found financing that would include his current mortgage inside the buyers mortgage What type of mortgage is this. Web An adjustable-rate mortgage is a home loan with an interest rate that changes over time based on market conditions.

Web Here are three key factors that can affect your mortgage interest rate. A wrap-around mortgage What factors affect. If a borrower decides to.

Your rate tends to be lower if you have a strong FICO credit.

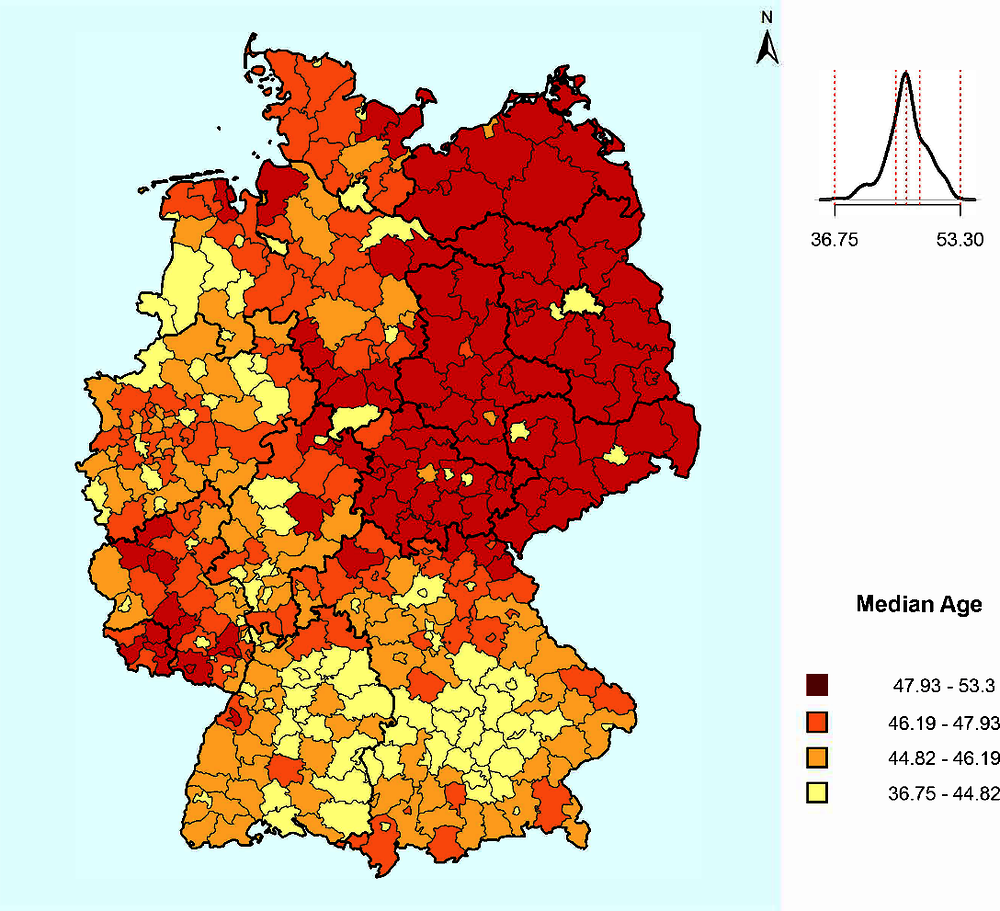

Full Article Chapter Four Europe

Adjustable Rate Mortgages As A Percentage Of Total Loans So Low

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

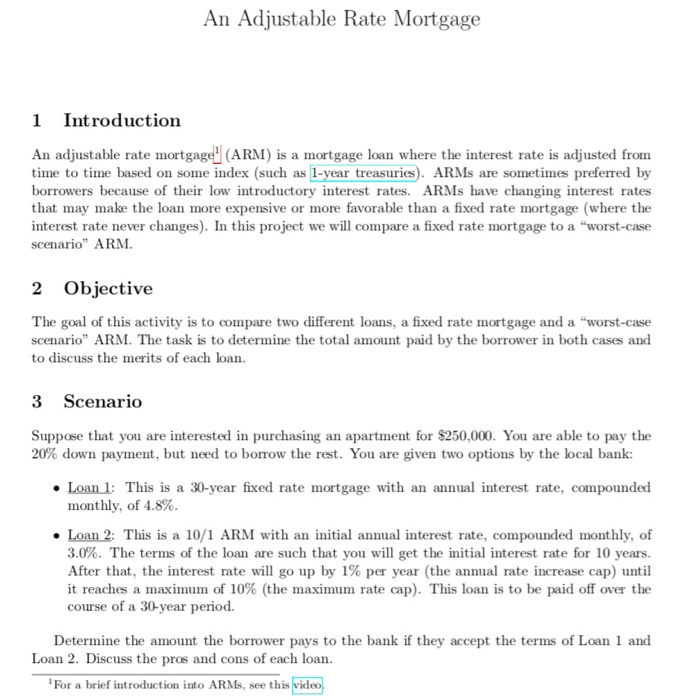

Solved An Adjustable Rate Mortgage 1 Introduction An Chegg Com

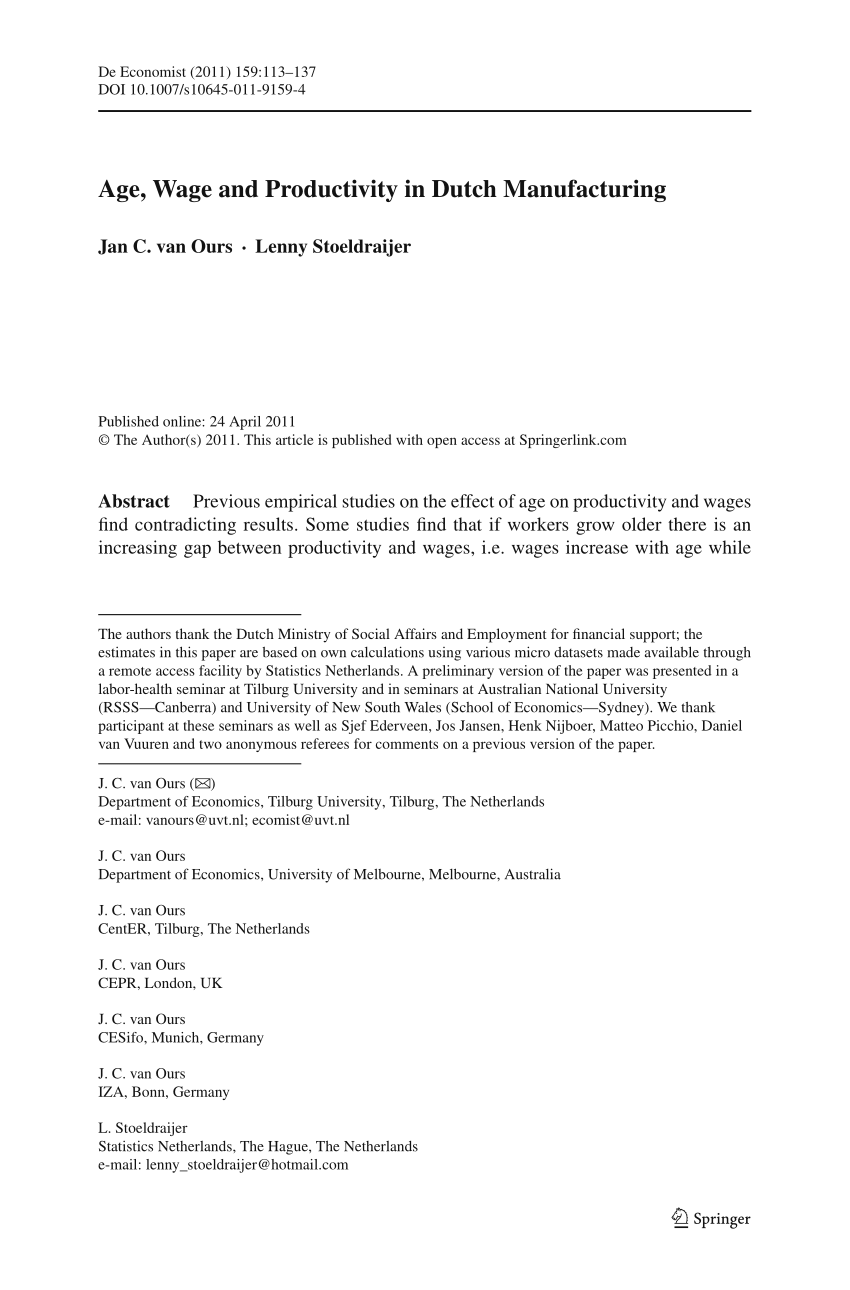

Pdf Age Wage And Productivity In Dutch Manufacturing

Adjustable Rate Mortgages Basic And Optional Features

How High Can An Adjustable Rate Mortgage Increase There S A Cap

Chart Fixed Rate Versus Adjustable Rate Mortgages

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

The Average Adjustable Rate Mortgage Is Nearly 700 000 Here S What That Tells Us Marketwatch

Doc Fn 444 Chapter 5 Kuoy Pheap Academia Edu

Ethereum For The Next Billion Who Are Your Next Billion Devcon Archive Ethereum Developer Conference

Adjustable Rate Mortgages Are Back But Are They Worth The Risk

Adjustable Rate Mortgage Definition Learn All About Arms

Calameo Ijp 6 2020

Riassunti Corporate Finance Sintesi Del Corso Di Finanza Aziendale Docsity

List Of Top Personal Loan Providers In Bagalkot Best Personal Loans Online Justdial